Reduce Financial Stress

According to Experian, the average American holds approximately $42,000 in consumer debt including $6,200 in credit card debt, $16,200 in personal loans and $19,200 in auto debt. Debt can negatively impact peoples physical and emotional health. What people may not realize is that getting out of debt and reducing financial stress can improve your physical and psychological health. According to one study of 22,000 women, those who reported 2 or more stressors had, “more prevalent hypertension, diabetes and obesity, than those who reported no financial strain.”

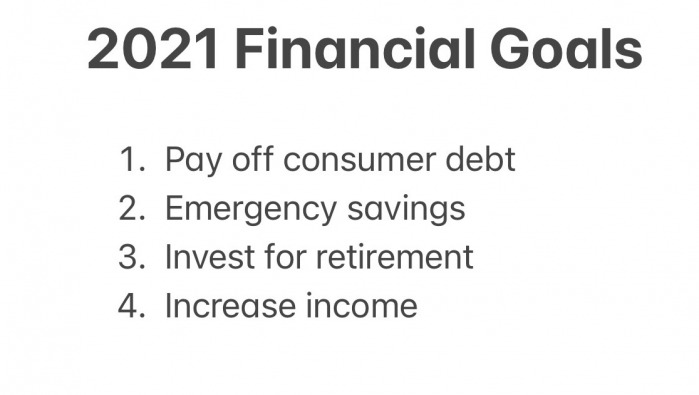

Goal setting helps to access where you are and where you are going. This way you are constantly checking to be sure you are heading in the right direction and you can set milestones and timelines to achieve them to help you remain motivated and on track.

Larger financial goals can include a long term retirement plan or even estate planning, medium size financial goals will be 5 to 10 year, and smaller financial goals can be daily, weekly, bi weekly, monthly, and quarterly goals.

There are a few main areas of financial health where you will want to set goals and its worth going through each area individually so that you can see your overall financial plan.

Goal Setting to Reduce Debt

Be aggressive, b.e aggressive! Your minimum monthly payments towards debt are taking up your monthly income and preventing you from increasing your wealth through other investments. Let’s power through that debt and free up your money moving forward!

Start by reducing your spending and put every single extra penny you have to completely paying off consumer debt. Did you know that in your Microsoft excel program on your computer there is actually a credit card payoff calculator?!? It’s amazing!

The first sheet with their auto calculations will be great for you to access how long it will take you to pay off your total credit card debt and how much you will pay in interest. I also went onto the next sheet, and broke down credit card debt by credit card and per month how much money can be paid to each one.

Start paying off the credit cards with the highest interest rate so that you to save some money on interest, and once you are done, you no longer have minimum payments to card A, that mount rolls into paying off card B on top of the minimum payment you were paying that whole time.

I’m using credit cards here as an example but if you have a car loan or personal loan you can use this same excel program and same process to pay these off.

While staying at home during the pandemic is certainly helpful for this initiative, recruit family and friends to join you on your financial health journey, share this article and my website with them, because the more people you have doing the same thing the better your chances of staying on track!

Saving Money

Sometimes when you have a large amount of debt and you are paying interest on it you will want to put savings on hold until your debt is cleared. Right now, I am using all of my funds to pay off my credit card debt at lightyear speed (approximately $30,000 in a mere 7 months!).

Even if you are in the throw everything at the debt stage you may want to set up a small amount of money each month or bi weekly to move into your savings account for a rainy day. Dave Ramsey promotes saving $1,000 as an emergency starter fund and then throwing the rest of your money toward your debt snowball before revisiting your savings.

This appears to be a sufficient temporary safety net until you get out of debt to cover unexpected emergencies so that they do not derail you from your goals. Once your debt is gone though, you should have 6 months of expenses saved up. Nerd Wallet has a calculator you just plug in your expenses and click next and it calculates for you how much money you should have saved as an emergency fund for 6 months of expenses, very cool tool check it out here.

Other major things to save up for include, a down payment on a home, renovations and a car. Having ample savings when making these purchases with put you in a better negotiation position to get the best deal and rates possible.

Investing Money

Creating well rounded financial goals for 2021 should be to start or continue with investment. I have my eye on Acorns, which allows you to automatically invest spare change or a set amount each month. Other investment sites are Weeble and Vanguard. Many financial institutions offer Roth IRAs, IRAs and other mutual fund investment opportunities.

I am planning on beginning to invest in the stock market for the first time this in August after I pay off all of my credit card debt. I’ll be documenting my research and experience as I do this so that you can learn from my successes and hopefully not my losses. More to come on this topic.

Increasing Income

Everyone’s situation is different but I think putting forth effort to figure out how you can bring more money into your household is a great way to improve your finances. Having more money can help you get out of debt faster, save up money faster and ultimately put money into investments where you can grow your money passively.

Increasing your income does not have to be getting a second job, but if it does take that perhaps it can be a temporary fix. A way to increase your income in your full time career is to position yourself to get a larger bonus or raise at work. In my experience, the squeaky wheel gets the grease! Ask to be assigned a mentor if you do not have one, someone who understands the company and how to succeed/grow there.

If you absolutely cannot take on additional and a raise/bonus is very far away or unlikely, changing jobs is also a great way to increase your income but you always have to weigh this with potential risks including lack of job security (last one hired first one fired) and quality of life factors.

Side jobs are very geographically specific and also person specific, you might have to be home for kids, or you might not be able to do physical labor etc. You have to figure out what you’re willing to do for what amount of money and then make that happen! If you can increase your income by even $10,000 this year, you’ll be much better off going into 2022!

Ultimately, keeping your mind set on increasing your income will help you to constantly be on the lookout for new opportunities to do just that.

Let’s get focused on improving our finances in 2021, this is our year!

2 comments

[…] The emphasis is on luck here. This was my first real estate purchase on my own and I think I happened be blessed with purchasing the right unit at the right time under the right circumstances. I truly hope that this happens for every single person reading this and that we can all make wise real estate investments to help grow financially. […]

[…] you have a career outside of the home your work hours and responsibilities are clearly defined as well as what the […]