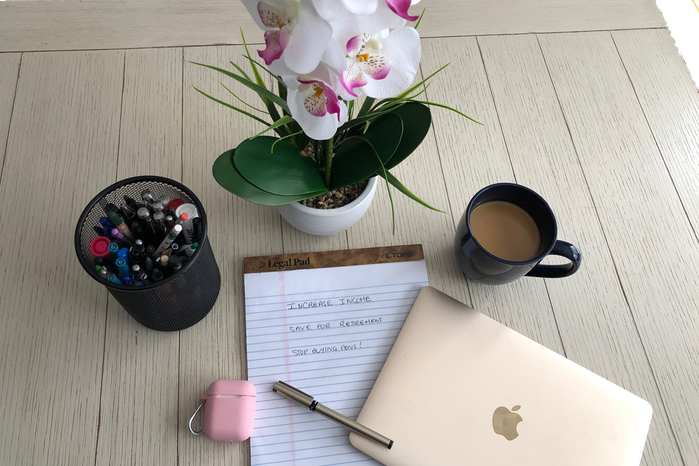

Top 3 Financial Mistakes to Avoid

Whether you are just starting your career or have been working for a few years it is much easier to set yourself up on the right path financially now then wait and have to fix your mistakes. Here are the top 3 financial mistakes you should avoid in your 20s and what to do instead so that you can achieve financial success the easy way.

1. Pretending Money Doesn’t Matter

One of the biggest financial mistakes that anyone can make is being lackadaisical about money. You can always stand make more money. And you should. Creating a mindset focused on financial advancement will provide you with a sound foundation for success.

Money is not everything and it is not even the most important thing in life but we all need it to survive, there is no way around it. So start focusing on how you can increase your income sooner rather than later.

The easiest way to increase your income is to change jobs because you are able to negotiate your starting salary, bonuses, benefits and overall lifestyle advancements more easily at that time. Once the company knows you’re willing to work in a particular position for that starting salary, it is typically hard to get large raises unless you are getting serious promotions.

While your first job you may have to take what you can get because you are there to gain experience, once you know what you are doing and ready for the next position, make your move! Do not get stuck.

Unfortunately, people often stay in the same position for the same company for years and as a result they likely earn 50% less than their peers according to Cameraon Keng at Forbs.

The standard for how often is acceptable to change jobs is ever changing but if you are ready for the next increase in income, benefits, independence, responsibility, reducing commute, etc. then update your resume and start looking. If you are getting interviews, then it probably is not too soon. Always prepare a legitimate and genuine reason for your need to switch jobs, even if you have only been at your current position for one year.

Coming out of law school I did not have any connections, my first job was part time with no benefits. After only 6 months, I leveraged the skills I learned to obtain an amazing position working for a medium size defense firm with offices at the wolf of wall street building, seriously.

The key here is, start looking for your next job while you are still employed, you will learn very quickly if you’re not getting offers because people want you to remain in your current position for longer.

If you need to remain at your current position for another year or so, max out your experience by taking on new responsibilities, exploring new areas of interest if they let you and of course advocating for yourself with your supervisors.

When your monetary obligations are small (no family yet) you can get comfortable making little money and before you know it, a decade has passed you by and you have missed out on many pay increases that your peers have taken advantage of.

Do not make the mistake of failing to create a strong mindset for growing your finances.

2. Not Saving For Retirement

Now is the time to start saving for your retirement! By making this a priority you are setting yourself apart from your peers financially. I failed to start saving for retirement until I was in my 30s and it is one of my biggest regrets. Apparently, I’m not alone according to this bank rate survey.

Why is this such a big regret? According to the experts, by starting to save for your retirement at age 25 v. age 35 you can nearly double your retirement savings, with only 10 years more of investing. See, Business Insider.

The easiest thing to do is to start contributing to your companies 401(k), particularly if your company offers any kind of match, I would max out that opportunity. The money will be taken out of your paycheck before you see it and this is a good thing because then you will learn to budget on less. This is a great benefit and you are losing money if you do not take advantage of this.

Outside of your companies 401(k) match there are so many opportunities now to invest in your retirement. You can hire a professional, open a roth IRA, create your own vanguard account or sign up for Webull or Acorns.

Another option is to just put money into a high yield savings account and pretend that you do not have access to it as it continues to grow! Put some time into researching what avenue you feel most comfortable with and what is available to you but you can increase the amount of money you have in retirement with little money put into it now v. waiting until you’re in your 30s to start.

3. Blowing Money Fast

First of all, if you have student loan debt, you have a negative net worth. You should not be spending money on expensive clothing, expensive dates or expensive cars. Don’t get me started on luxury vacations. If you have any student loan debt, car debt, personal loan debt, credit card debt, any consumer debt at all, you need to get out of debt as fast as possible and stop spending.

In your 20s with little income but also little responsibility it is the perfect time to become debt free so you can move forward using your money for investments. I regret every single time I spent money on something that I did not truly need in my 20s and I wish I had used that money to fund my education and take out less loans, or invest in my retirement.

There are many theories on the best budget but this will vary depending on your situation. Put all of our effort into getting out of debt, then saving/investing, then, once you have a good foundation, start using money for entertainment purposes (you’ll have a lot to be able to use then).

2 comments

Such an honest post! With so many people in debt, this is what we should speak about more often. I am all for breaking any money-related taboos, and I deeply appreciate the case that you’re making. Money management should be taught in school to each and everyone of us. It’s just part of life, so it feels strange that this important part just gets skipped (at least in The Netherlands, where I am from). Also thank you for the inspiration on some alternative ways to build an additional retirement plan, have jotted some thoughts down already. Great read! Love, Susanne

Thanks for sharing these tips. I have started working on my financial wellbeing, I’m in my late 20’s and glad I realized the importance of your tips.